FAQs for International SR&ED Claims

Can your business receive SR&ED tax credits as a non-Canadian business? How about if you’re doing R&D work outside of Canada? The answers to these questions may surprise you.

Can your business receive SR&ED tax credits as a non-Canadian business? How about if you’re doing R&D work outside of Canada? The answers to these questions may surprise you.

The tech industry is constantly changing and growing. Here are some top trends to watch out for in 2024.

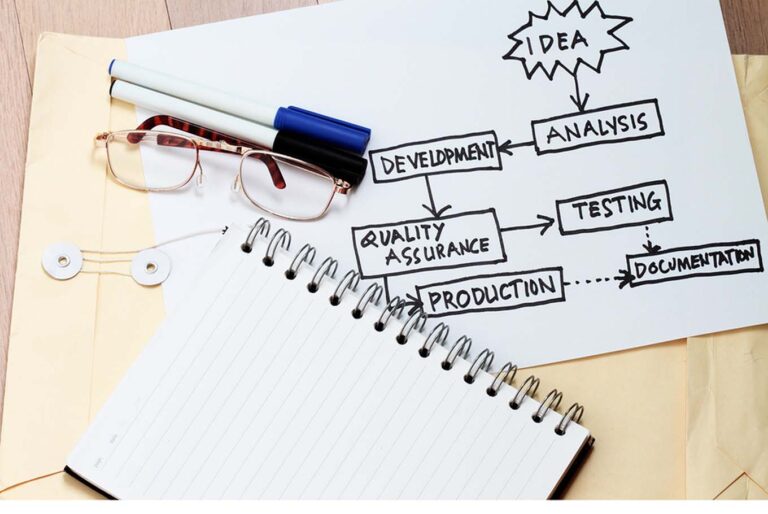

SR&ED is an incredible opportunity for many Canadian organizations looking to conduct research and development (R&D). Are you eligible?

Canadian businesses in the AV sector have a wide variety of programs available to improve technologies, perform R&D, and much more.

Want to find out if your R&D project is eligible for tax credits through the SR&ED funding program? Learn how the program defines eligible experimental production.

Projects eligible to receive Scientific Research and Experimental Development (SR&ED) tax credits need to prove their project is innovative enough for funding. We take a look into what this means.

Scientific Research and Experimental Development (SR&ED) tax credit requires projects to have technological uncertainty or be a part of a complex system, but how does the program define that?

In the Federal Budget 2022, Ottawa announced its plans to review its Scientific Research and Experimental Development (SR&ED) program, with a primary goal of improving Canada’s ranking on research and development.

Many Canadian organizations often ask, “How will SR&ED impact my business’s taxes?” This article outlines what to expect.

The Tax Court of Canada released its decision in the Buhler Versatile Inc. vs. His Majesty the King case, and Justice Wong’s decision provided positive implications for system uncertainty that claimants should consider when structuring a SR&ED claim.