Applying for SR&ED During Experimental Production

Want to find out if your R&D project is eligible for tax credits through the SR&ED funding program? Learn how the program defines eligible experimental production.

Want to find out if your R&D project is eligible for tax credits through the SR&ED funding program? Learn how the program defines eligible experimental production.

The Meat Processors Capacity Improvement (MPCI) Program will provide up to $150K to support improving meat handling and processing equipment, technologies, and practices.

The Canada and Ontario Auto Pact represents a commitment from the Canadian and Ontario governments to solidify the fast-evolving EV automotive landscape and aim to foster economic growth through sustainable initiatives.

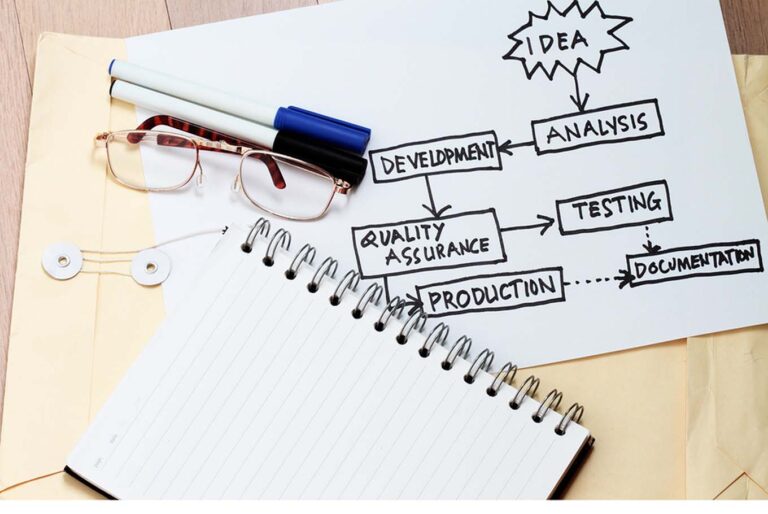

Projects eligible to receive Scientific Research and Experimental Development (SR&ED) tax credits need to prove their project is innovative enough for funding. We take a look into what this means.

BSP provides Ontario businesses up to $10 million loans to adopt/adapt innovative technologies that support productivity, expand operations, and increase exports.

Innovative Solutions Canada (ISC) has open funding opportunities in which eligible businesses can receive government funding support on focus projects.

The DIGITAL Horizon AI’s Technology Commercialization Program offers up to 35% of eligible costs with a minimum of $1M in funding to help research artificial intelligence (AI) solutions for strengthening intellectual property and data management.

Through a combination of various funding programs, Mentor Works, a Ryan Company, has helped Takumi access over $1.5M in grants and loans for economic growth and strategic innovation projects.

The EIP Program is looking for proposals to provide R&D grants for projects that focus on lowering emissions for the transportation sector.

Eligible applicants can access up to 49% of project costs in grant funding from the Skills Development Fund – Capital Stream with no maximum amount restrictions.