Personal Finances: Efficiency in the Rental Market

As Mentor Works’ resident Fresh Prince of Frugality, I am constantly thinking about how I can reduce my living expenses to increase my flexibility to save, invest, and plan for the future. I often hear people discussing whether or not renting makes financial sense. Owning your own property has several major benefits, and renting can be seen as throwing money away, but it’s not necessarily a negative situation. Below are a couple of methods for enhancing personal financial efficiency which have worked well for me, and are easily accessible for virtually anyone.

If You Rent, Stay in the Same Apartment as Long as Possible

A common rule of thumb in the rental market is to not spend any more than 30% of your overall income on rent, with the sweet-spot being approximately 25%. This number, however, is generally based on giving us the ability to cover our expenses. I don’t know about you, but I don’t only want to just cover my expenses, but make progress towards financial freedom and flexibility.

When I was working as a landscaper and my wife was working part-time while finishing up her University education 3 years ago, rent accounted for approximately 23% of our overall expenses. We found an affordable, nice enough 1-bedroom apartment, which only became somewhat cramped when we added an overweight cat named Sherbert to the mix. Once our circumstances had changed for the better, my wife and I decided to stay in our cozy, 650 sq. ft. apartment, making rent represent 14.5% of our total expenses. This trend has continued, as, when we did move, we managed to find another apartment at the same low price-point we had found with our previous apartment, and today rent represents 12.9% of our overall expenses. By remaining in the same, cost-effective apartment as our income increased, we experienced significant savings over the option of increasing our standard of living to where housing represented 25%-30% of our overall income.

Another reason to stay in the same apartment is to shield yourself from annual rent increases, which are limited under leases by a guideline rate set by the Provincial Government (0.8% maximum rent increase in 2014). When we decided to move into our 2nd apartment, we were fortunate enough to find seemingly the only apartment in Kitchener-Waterloo which was available for rent at the same price point as when we had secured our first apartment in 2012. In each of 2011, 2012, and 2013, average rental costs grew in Kitchener-Waterloo-Cambridge by more than the Ontario Provincial average, exposing those not already renting to increases in housing costs. For most large metropolitan areas in Ontario and across Canada, this trend holds true. If you can find a good deal in this market, it may be best to cling on to it for all its’ worth (which, in personal finance terms, can be a lot).

To put this choice into perspective, living in an apartment below my financial means (the 25% of income mark), but which satisfies all of my needs for a place to live, saves me up $700 monthly, and over $8,000 annually.

Move Closer to Work

Yes, this advice may contradict my first point, but a key factor to renting efficiently is to optimize your commute as much as possible. Ideally, a reasonably cost-effective apartment could be found within a close distance of your workplace.

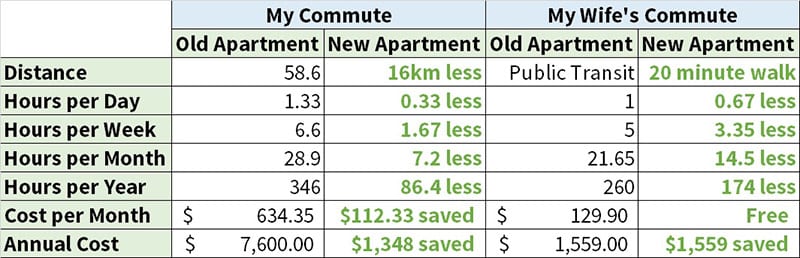

After nearly 8 months of working at Mentor Works, I decided that my commute, as well as my wife’s, was costing us too much time and money even though our apartment at the time was highly cost effective:

I know what you’re thinking, but cars are much more expensive to operate than many of us may think. Now, the CRA’s mileage allowance rate factors in expenses such as car loan financing costs, depreciation, wear and tear, insurance, fuel, etc., but, since I drive a car which I purchased with cash, and which I will likely never re-sell (I plan to “drive it into the ground,” perhaps literally), my actual cost of commuting was lower than the $7,600 I have calculated, but for many Canadians it is a frighteningly accurate number. Just keep in mind that fuel cost is actually a relatively small portion of the costs related to car ownership.

My true cost of commuting at that point in my life can be conservatively estimated at $5,000 annually ($0.33/km), bringing me and my wife’s combined commuting costs to over $6,500 annually (nearly as much as our annual rent costs). With these startling figures in mind, we decided to move closer to both of our places of work, and move as close to the regional highway as possible to make travel more efficient. From our new apartment (same rent cost as our previous apartment), we experienced the following savings:

Wrapping Things Up

These pieces of advice may seem cliché or over-simplistic, but the results have spoken for themselves. By making these 2 simple commitments to financial efficiency, I have reduced my expenses by up to $11,000 annually. If you are feeling stressed due to time constraints, financial over-commitment, or other side effects of financial inefficiency, these simple strategies to simplify your life and give you enhanced financial flexibility may act as an impactful starting point, providing more free time and significantly more money in your pocket.