Home Ownership as an Investment

In Canada, home ownership is widely seen as a key part of a long-term personal investment strategy. The 2011 National Household Survey (NHS) conducted by Statistics Canada reveals that 69% of households own their own homes (including both mortgaged homes and fully paid off).

Unfortunately, home purchase is not necessarily a strong investment or a wise decision for many Canadians, as over 25% of households spent more than 30% their overall income on housing, largely attributable to the increased costs of home ownership (mortgage interest, utilities, property taxes, upkeep & maintenance, etc.) rather than renting. The 30% mark is used by the Canada Mortgage and Housing Corporation (CMHC) as a threshold to determine affordability of housing; anything above 30% of an individual’s income spent on housing is considered to be unsustainable financially.

On average, of households which exceeded the 30% affordability threshold, home owners exceeded it by an average of $617 per-month ($7,404 annually), whereas renters exceeded it by $403 per-month, magnifying the extent to which over-investing in home ownership impacts some Canadians’ cash flow situations.

Home Ownership & Debt

It is important to stay within your means financially. The 30% of income on housing threshold is a strong indicator of financial survivability, rather than financial health. Having this number be as low as possible while still meeting your housing needs (i.e. additional rooms for children, adequate storage space, etc.) is a key indicator of financial health. In my previous article on the benefits of renting, I stated that my housing as a percentage of overall income was 12.9%. Seeing as I have remained at the same 1-bedroom apartment that meets all of my needs, my housing expense as a percentage of overall household income has improved to under 9%, simply by not “upgrading” by purchasing additional living space which I don’t actually need. This leaves a lot of money to save away, rather than spending up to the 30% threshold and living paycheque to paycheque as many Canadians choose to do.

The tendency for the majority of Canadians to own their homes has resulted in 70% of all household debt consisting of mortgages. Though there is a chance that this debt will result in a return as housing prices rise, housing prices are not uniformly growing across Canada, but rather growth is focused in major population centers such as the GTA and Vancouver. Many other smaller markets across the country are experiencing relatively flat growth, having the effect of limiting the return on investment for making a home purchasing decision.

An Alternative to Home Ownership

It would seem as if home ownership is a fully ingrained part of North American culture. We purchase because we consider homes to be a reasonable investment (which is not always the case), and perhaps as a status symbol. But what if I told you that Germany has developed a system which limits household debt while providing citizens with all of the living space that they need?

The German housing strategy is unique, in that it uses a blend of enhanced freedom and enhanced regulations to tweak supply and demand for housing, with the intent being to keep it affordable for all. DeStatis reported in 2013 that only 43% of German households owned houses, compared to Canada’s 69%. Keep in mind that Germany’s unemployment rate is just 4.7%, compared to Canada’s 7%, and according to the Organization for Economic Co-operation and Development, Germans have the 6th highest take-home pay after-taxes in the world at $45,687, while Canada is 20th with $35,471, despite a much higher average tax burden for German citizens.

Germans have superior purchasing power, so why don’t they invest heavily in real estate? Below are 3 major reasons:

1. Rent Control Regulations

The German rent control system is focused on upholding renters’ rights, including controls on rent increases, and making the eviction process more difficult for landowners to force upon tenants. In July 2015, Berlin introduced tightened rent control measures to combat increases in the price of renting in Germany’s capital. A local board establishes an average rental price per-square meter, and new rental contracts cannot exceed this rate by more than 10%. These controls resulted in a 3.1% decrease in average rental prices within their first month.

2. Mortgage Regulations

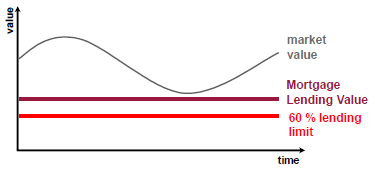

The Association of German Plandbrief Banks lists the 60% mortgage lending limit enforced by German banks as a key reason for the flat pricing of houses. When you apply for a mortgage in Germany, you must put down 40% as a down-payment before the lender is willing to provide 60% of the value of a house. You may remember that U.S. banks giving away low down-payment mortgages to financially unstable masses resulted in the global recession of 2008-2010, and mortgages in Canada are also easy to come by. After just a year of stable employment, I was pre-approved for a $450,000 mortgage (I will not be taking the bank up on this offer) and a mortgage with only 5-10% for a down payment is completely achievable in this market. The German system takes away the ability to get yourself in over your head with mortgage debt by demanding that home buyers actually own a large portion of their home. If German banks are wary of taking on this type of debt, why are Canadians falling over themselves to take on 80-95% mortgages?

The Association of German Plandbrief Banks lists the 60% mortgage lending limit enforced by German banks as a key reason for the flat pricing of houses. When you apply for a mortgage in Germany, you must put down 40% as a down-payment before the lender is willing to provide 60% of the value of a house. You may remember that U.S. banks giving away low down-payment mortgages to financially unstable masses resulted in the global recession of 2008-2010, and mortgages in Canada are also easy to come by. After just a year of stable employment, I was pre-approved for a $450,000 mortgage (I will not be taking the bank up on this offer) and a mortgage with only 5-10% for a down payment is completely achievable in this market. The German system takes away the ability to get yourself in over your head with mortgage debt by demanding that home buyers actually own a large portion of their home. If German banks are wary of taking on this type of debt, why are Canadians falling over themselves to take on 80-95% mortgages?

3. Freedom to Build Means Maximized Supply of Housing

German zoning laws are much more liberal than Canada’s in that land owners are allowed to build what they want, when they want, in the way that they want, whether it be commercial or residential. This flexibility provides greater supply of land for new houses, and limits the opportunity for large developers to buy up large plots of land and create local monopolies, as they do in North America. The ability for individuals to easily buy land and have the freedom to easily build homes to their desired specifications allows the market to provide sufficient supply to meet demand for new housing, keeping house prices low.

The end result of these policies is that average rent prices in Munich, Germany’s most expensive city to live in, are 1/3 those of the average of London, England, and other major western cities.

Deciding on Home Ownership

Unfortunately, the North American real estate market makes it attractive for consumers without the means to pay a fraction of a home’s cost to take on tremendous debt with high risk. Unexpected job loss or a housing bubble burst can leave a large number of Canadians in dire financial straits. Owning a house (as in owned by the resident, rather than a bank) is not a poor financial investment in many cases, but paying interest on a large mortgage, possibly for decades, will eventually result in a large amount of money lost to simply service the mortgage debt month-to-month over the term.

Below are the key reasons why I have chosen to not invest in the Canadian real estate market:

- Diversification: A large real estate investment would represent likely close to 100% of many Canadians investment portfolio; diversification is key to protect against risk. A real estate dip or bubble-burst, along with a situation in which you are obliged to move (new job, etc.), could result in massive losses on investment. I don’t want to put all of my eggs in one basket.

- Unforeseen Costs: Often homebuyers do not factor in the approximately $5,000 necessary to re-roof a house, or the upwards of $10,000 needed to replace broken or outdated heating systems, let alone just routine maintenance/renovation costs that are unnecessary when renting.

- Flexibility: Renters can move wherever, whenever, at little cost to themselves, whereas a home purchase makes such transitions much more difficult and likely much more expensive.

- Efficiency: With less (but more than enough) space, renters are less tempted to purchase clutter to fill that space, saving money and regrets.

- Cost-Effectiveness: Regardless of what people may say about throwing good money down the “rent hole,” I manage to house myself, my wife, and an obese cat in a 550 sq. ft. space for approximately $700 per-month (~$8,500 annually), in one of Canada’s most active and lucrative real-estate markets (Kitchener-Waterloo). Home ownership (specifically a cheap house for this market, at approximately $250,000) would cost much more than double this amount monthly when property taxes, maintenance, utilities, etc. are factored into the equation, and I can simply invest my savings into long-term investments which are likely to out-perform the highly cyclical real-estate market.