These 3 Factors Will Define the Canadian Manufacturing Sector in 2016

The Canadian manufacturing industry remains cautiously optimistic moving forward in 2016. While some sectors within the manufacturing industry are seeing rapid growth, others are stagnant or contracting due to a variety of economic and labour issues.

This type of uncertainty isn’t new to manufacturing executives, but being able to plan ahead and execute growth strategies is becoming increasingly important. To effectively lead through this period of change, manufacturers need to understand how their industry is changing over time.

PLANT Magazine, a leading national publication for Canadian manufacturing news, in partnership with Grant Thornton LLP administers annual manufacturing surveys known under the title Manufacturers’ Outlook. The data collected through these surveys are provided by senior managers from manufacturing firms across Canada and benchmark a variety of key performance indicators (KPIs) that measure the Canadian manufacturing landscape.

The following figures have been pulled from the Manufacturers’ Outlook survey from last year (2015) and this year (2016) to provide trends and show where manufacturers are headed into the future. Extra commentary will be provided to give manufacturing executives some guidance about ways to overcome difficulties and build a stronger business.

1. Manufacturing Business Structure, Markets, and Financing

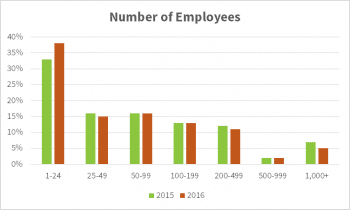

This year’s employment figures are fairly consistent with 2015 aside from one significant increase in the rate of small businesses. Manufacturers employing 1-24 people rocketed up from 33% to 38% in the past year.

Although this is likely a sign of new manufacturers entering the market, one must also notice a minor drop in employers hiring 25-49 employees. Contraction of mid-sized employers is not an encouraging sign for the manufacturing industry, and employers should continue evaluating options that will enable them to grow the size of their workforce.

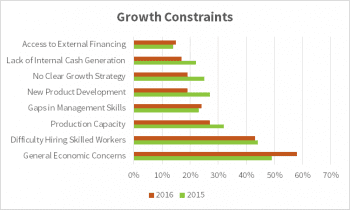

Coming as no surprise to many, the top manufacturing growth constraint is having a fragile economy. It’s tough for businesses to forecast future demand and performance, thus making it difficult to confidently make investments.

Coming as no surprise to many, the top manufacturing growth constraint is having a fragile economy. It’s tough for businesses to forecast future demand and performance, thus making it difficult to confidently make investments.

On a positive note, fewer manufacturers are citing other growth constraints, including a 5% reduction in production capacity. Although limited, business investments over the last few years are beginning to offer increased production capabilities and fewer concerns about meeting demand for their goods.

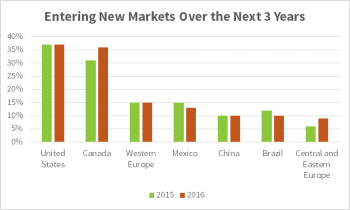

Increased production capacity will enable many manufacturers to enter new markets over the next few years, of which, expanding into the United States remains the most popular option. Fewer companies are feeling restricted by internal trade barriers, which will also increase the amount of markets available domestically.

Outside of North America, European markets are becoming more

favourable to Canadian manufacturers. Asian markets such as China, India, Japan, and Korea will offer manufacturers with additional opportunity, however no significant increases or decreases in these markets were noted over historic values.

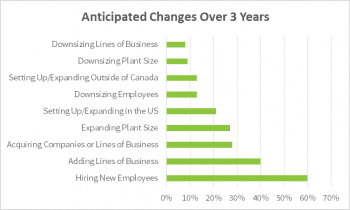

Among the greatest anticipated business changes over the next three years are hiring new employees (60%), adding new lines of business (40%), acquiring companies or lines of business (28%), and expanding plant size (27%).

These metrics overwhelmingly indicate that businesses plan on growing over the next three years. These changes will be implemented by maintaining the right mix of employees and automated processes to ensure that the business can keep up with demand.

These metrics overwhelmingly indicate that businesses plan on growing over the next three years. These changes will be implemented by maintaining the right mix of employees and automated processes to ensure that the business can keep up with demand.

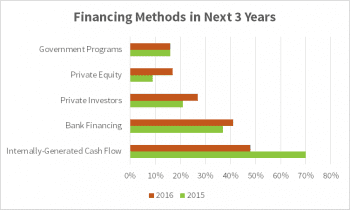

But how will manufacturers actually finance this expansion? The industry that has traditionally been financed through internally generated cash flows, however manufacturing executives are shifting away from this model. This year, only 48% of companies will use retained earnings to support business expansion. Their financing will increasingly come from banks (41%), private investors (27%), and private equity (17%). Canadian government funding programs remain a distant consideration for many manufacturer s; only 16% will choose to pursue government funding through grants and loans, as well as the SR&ED research and development tax credit.

s; only 16% will choose to pursue government funding through grants and loans, as well as the SR&ED research and development tax credit.

Canadian business grants and loans provided by the government are an excellent way to extend internally-generated cash flows and provide funding for your company’s next project. The 16% of manufacturers who plan on using these programs over the next three years will have access to more funding and will be able to expand their business in a faster, less risky way than if they relied on retained earnings alone. Learn more about Canadian government grants.

2. Manufacturing Industry’s Commitment to Research and Development

The Canadian government has urged businesses, especially manufacturers, to develop an innovative mindset going into the future. Canadian businesses lag behind other developed nations in terms or research and development spending, and it will only become a bigger problem in the future. Without constant innovation, Canadian businesses will lose competitive advantages compared to other countries and earning potential will suffer as result.

The Canadian government has urged businesses, especially manufacturers, to develop an innovative mindset going into the future. Canadian businesses lag behind other developed nations in terms or research and development spending, and it will only become a bigger problem in the future. Without constant innovation, Canadian businesses will lose competitive advantages compared to other countries and earning potential will suffer as result.

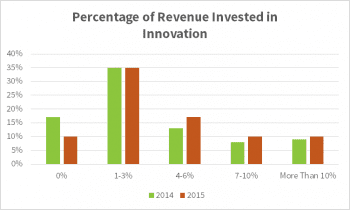

Many Canadian manufacturers currently devote 1-3% of company revenues to innovative projects, while 10% of manufacturers contribute none of their budget towards research and development. Although this remains shockingly high, there is significant improvement over 2014 when 17% of companies were not performing R&D projects.

As shown on the graph, an increased number of businesses will be spending 4-10% or more of their budgets on innovative research and development projects this year. This increase will help businesses diversify their product offerings and ramp up production methods to ensure that they can keep up with growing demand.

As shown on the graph, an increased number of businesses will be spending 4-10% or more of their budgets on innovative research and development projects this year. This increase will help businesses diversify their product offerings and ramp up production methods to ensure that they can keep up with growing demand.

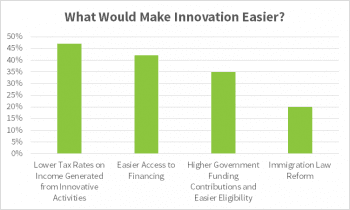

When questioned about what would help manufacturing executives to increase their commitment to innovation, 47% cited lower tax rates on income generated from innovative projects to be important. A close second, 42% of manufacturers cite easier access to funding being an issue. Higher Canadian government funding contributions and easier eligibility requirements would also greatly increase the ability for manufacturers to implement more research and development projects.

There are a variety of Canadian government funding programs that directly support business research and development projects.

The most common of these programs is the Industrial Research Assistance Program (IRAP) which can offer businesses up to 50% of contractor labour fees and up to 80% of internal labour costs that are required to solve a business’ internal technical challenges.

3. Workforce Development and Manufacturing Training for Employees

Employees are the foundation of any successful manufacturing business. Manufacturers often cite the lack of skilled labour in Canada to be a main constraint to growth, and overcoming this challenge can be quite difficult. In order to grow and provide the products and services demanded by global customers, manufacturers must find a way to close the widening skills gap and ensure they can keep up with their competition.

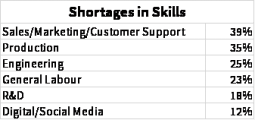

What are the major skills gaps identified by manufacturers? Shockingly, business development professionals top the list this year. Sales, marketing, and customer support staff are needed to continue growing the business in a competitive, valuable way.

What are the major skills gaps identified by manufacturers? Shockingly, business development professionals top the list this year. Sales, marketing, and customer support staff are needed to continue growing the business in a competitive, valuable way.

Behind those positions, production (35%), engineering (25%) and general labour (23%) workers are needed to keep business operations running smoothly. These skilled labourers are always in demand by growing companies, however ongoing training programs have helped manufacturers ensure that they have the skills needed to complete design and production tasks.

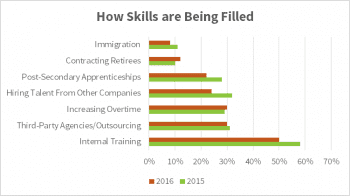

Internal training programs lead the way for manufacturing skills development with 50% of companies reporting that they provide these types of training to their staff. Staffing services and outsourcing positions is another popular method with 30% of manufacturers reporting that this is part of their overall strategy. Among some of the less-used options are using post-secondary apprenticeships (22%) and recruiting economic immigrants who are seeking high-value, well-paying jobs in Canada.

Internal training programs lead the way for manufacturing skills development with 50% of companies reporting that they provide these types of training to their staff. Staffing services and outsourcing positions is another popular method with 30% of manufacturers reporting that this is part of their overall strategy. Among some of the less-used options are using post-secondary apprenticeships (22%) and recruiting economic immigrants who are seeking high-value, well-paying jobs in Canada.

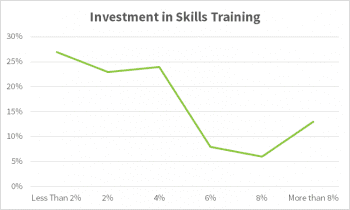

With so many manufacturers leaning towards providing training programs for their employees, they must also consider the cost of providing training as opposed to recruiting employees that already have the skills. As a percentage of revenue, half of Canadian manufacturers will spend 2% or less of their revenue of skills training programs, while an additional 24% of manufacturers will spend between 2-4% for these programs.

Manufacturers might not know the extent of Canadian government funding programs that are available for them to train their workforce. Several business grants exist to provide internal or third-party training programs. One of the most common programs available to manufacturers is the Canada Job Grant, a federal initiative with streams that are specific to individual provinces. For example, the Canada-Ontario Job Grant (COJG) provides employers with up to 66% of third-party training costs. For small businesses with less than 50 full-time employees, this contribution is increased to 83% and can cover employee payroll costs while the training is being performed.