Canada’s State of Trade 2019: Part 1 – Key Points for Canadian Exporters

Global Affairs Canada has released Canada’s State of Trade, an evaluation of the country’s economic performance. The report highlights and assesses key developments in Canada’s international trade and examines domestic and foreign economic trends.

According to the report, the global economy has seen weaker growth than in previous years; however, Canada’s exports and imports both saw a slight rise.

The total value of trade in goods and services in Canada reached a record high of $1.5 trillion in 2018.

The report was created by the Office of the Chief Economist, which provides analysis and research in relation to Canada’s international trade in order to support Global Affairs Canada’s priority policies and activities.

Global Economic Decline – Except for the US

While 2016 and 2017 saw an increase in global economic growth, according to the report, this momentum slowed in the second half of 2018 as a result of rising trade tensions, lower business confidence (based on opinion surveys), and policy uncertainty across multiple international economies, including those of some of Canada’s top trading partners.

For example, uncertainty regarding Brexit negotiations decreased growth in the United Kingdom from 1.8% to 1.4%. Growth in emerging markets also slowed. China saw a decrease from 6.8% to 6.6% due to regulatory tightening, and Mexico saw a slight decrease from 2.1% to 2%.

The exception to global economic decline in 2018 was the United States, which saw increased growth from 2.2% to 2.9%.

According to Global Affairs Canada, growth in the US was a result of a tight labour market (high employment leading to an escalation in wages), an increase in goods and services purchased by consumers, and lowered taxes.

However, the International Monetary Fund (IMF) predicts a decline in growth in the US by EOY 2019 and into 2020, due to trade and political uncertainties, inevitable global economic cycles of ebb and flow, and the waning positive impacts of tax reform.

Canada’s Imports and Exports: Moderate Success but Room to Grow

Despite the overall global decrease in economic growth, the Office of the Chief Economist found that Canada’s imports and exports continued to increase, and the Canadian economy grew by 1.9% overall in 2018. This is down from 3% in 2017 as a result of high household debt, which decreased household consumption.

The unemployment rate dropped in 2018 to 5.8%, its lowest rate since 1976. Additionally, average hourly wages increased by 2.9%, the highest growth since 2012, as a response to a tighter labour market.

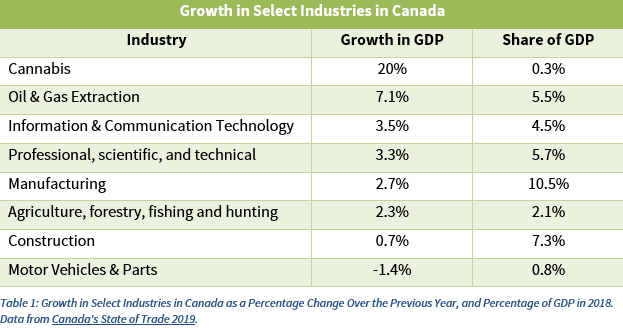

Growth for Key Industries

Cannabis was the top industry for economic growth (20%), due to new government regulations, while Oil & Gas and ICT also saw significant growth (7.1% and 3.5% respectively).

Canada’s State of Trade: Exports on the Rise

Canada’s exports increased by $41 billion in 2018, to total $706 billion. Because export growth was higher than import growth, Canada’s goods trade deficit—the amount by which the country’s imports is higher than its exports—was $2.7 billion lower than in 2017.

According to the State of Trade report, exports rose in all sectors, except motor vehicles and parts. Energy exports had the highest growth, increasing by $14 billion, followed by consumer goods, which grew by $3.6 billion, and forestry, building, and packaging products, which grew by $3.4 billion. Expansion in volumes, rather than in export prices, drove export growth. Exceptional shifts in export volumes in 2018 were for metal ores and minerals, aircraft and other transportation products, and energy products.

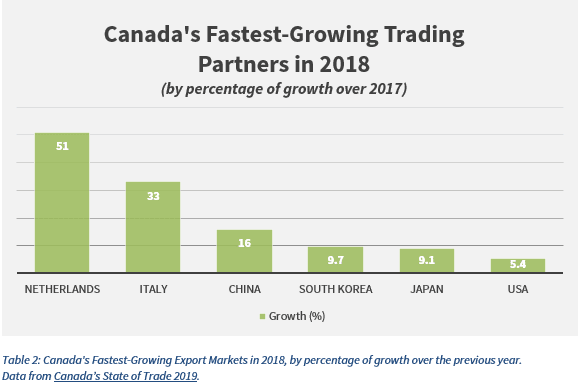

Canada’s top trade partner continued to be the US, with exports to the US rising 5.4%, or $22 billion, to $433 billion in 2018.

However, Canada saw some trade diversification away from the US, with overall growth to non-US destinations up 9.8% (or $14 billion).

Among non-US trading partners, exports to China recorded the fastest growth (+16%), followed by South Korea and Japan (see Table 3).

Export Outlook

Global trade tensions between the US and its trades partners, as well as tensions surrounding Brexit, contribute to uncertainty in the global economic forecast. Ongoing, heightening tensions can reduce demand, disrupt supply chains, and depress business confidence. However, if trade tensions are resolved, according to the federal government, economic activity could be stronger than expected.

Trade Diversification & Exporting Resources for Canadian Businesses

The Canadian government has recognized the need to further diversify Canadian exports and is targeting export growth of 50% by 2025. The government’s strategy to achieve this target includes giving Canadian businesses more resources to execute export plans and improving trade services for Canadian exporters.

Small and medium-sized enterprises (SMEs) that currently or intend to export may wish to learn about the Government of Canada’s CanExport SMEs Program, which provides funding of up to $75,000 for export marketing projects, including attendance at trade shows and other activities.

Part 2 of this blog on Canada’s State of Trade 2019 will review Canada’s need for trade diversification and business strategies to increase exports. Make sure you’re subscribed to Mentor Works Weekly E-Newsletter, so you don’t miss it!