Canada’s Federal Budget 2023: What You Need to Know

On March 28, 2023, Canada’s Finance Minister Chrystia Freeland tabled this year’s federal budget, her third , titled “A Made-In-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future”. The total budget is set at $43 billion in new spending, to be used now and through the following five years, with three key focus areas: inflation relief, lowering taxes, and optimizing health and dental care.

For small business support, the budget has announced a new clean technology manufacturing tax credit to support Canada’s zero-emissions goal, investments for critical minerals, and the upcoming new intake for the Canada Growth Fund.

Key highlights in the Federal Budget 2023 include a new grocery rebate measure to help Canadians with food affordability, an increase in the RESP withdrawal limit to support Canadian students facing a higher cost of education, the creation of a new Canadian Dental Care Plan to be implemented by 2025, and a commitment to create a national pharma-care program.

“Canada is filled with people who can do big things, and I have never been more optimistic about the future of our country than I am today. At a challenging time in a challenging world, there is no better place to be than Canada.”

Chrystia Freeland, P.C., M.P. Deputy Prime Minister and Minister of Finance

This article provides information from the Federal Budget 2023 as it pertains to Canadian businesses across various industry sectors. Please use the table of contents below as a reference guide for important sections from the 270-page Budget 2023 document:

Want to learn more about other provincial and federal budget updates from 2023? Check out our 2023 budget highlights page for a collection of reviews.

Stimulating Canada’s Economy

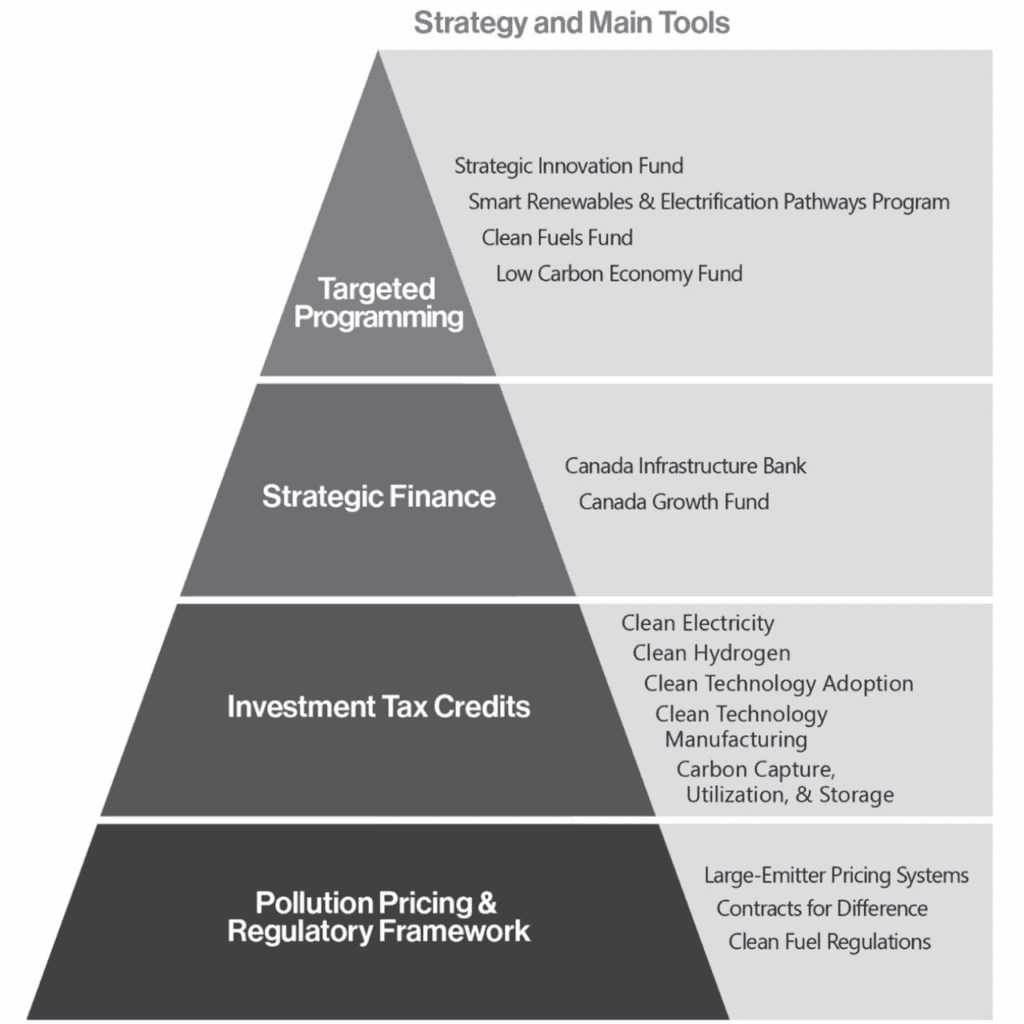

The Federal Budget 2023 will invest in the economy by directing significant funds to sustainable technologies and the workforce. Specifically, the new Canada Growth Fund (first mentioned in the 2022 federal budget and fall economic statements) will receive a massive allocation, as well as the Strategic Innovation Fund (SIF)

Sustainable Technologies

- To attract private capital, the Canada Growth Fund will begin investing $15 billion in the first half of 2023, functioning as an arm’s length public investment vehicle. Using investment instruments that absorb risk will encourage private investment in low carbon projects, technologies, businesses, and supply chains to build the clean economy for Canada; and

- The government will contribute $500 million over the next ten years to the Strategic Innovation Fund to support the development and application of clean technologies in Canada. In addition, up to $1.5 billion of its existing resources will be redirected to projects related to clean technology, critical minerals, and industrial transformation.

Investing in the Workforce

- Tradespeople can deduct up to $1,000 (doubled from the current $500) in tool expenses from their employment deductions in Budget 2023, to help them invest in the equipment they need to do their jobs;

- As part of the Labour Market Transfer Agreements in 2023-24, an additional $625 million will be allocated to ensure Canadians have access to the support they need to get their next job. This includes skills training, on-site work experience, career counselling, and assistance with job searches;

- To ensure that the Work-Sharing Program continues to provide timely support to Canadian businesses and workers, Budget 2023 will provide $5.4 million over three years, beginning in 2023-24; and

- A $197.7 million partnership between postsecondary education institutions and employers will enable students access to high-quality work-integrated learning opportunities via the Student Work Placement Program.

Interested in learning more about funding your hiring and training efforts for your business? Watch the video below to see how government grants can help.

Transportation and Infrastructure Funding

In the Federal Budget 2023, the Canadian government announces new investments to improve Canada’s transportation and supply chain systems so that they are more reliable and resilient for Canadians and Canadian businesses. Considering British Columbia’s recent economic challenges due to supply chains disruptions, there is both continued and new support for transportation supply chain projects across the country including bridges, roads, airports, railways, and ports.

Strengthening Supply Chain Infrastructure

- $119.6 million over five years to Fisheries and Oceans Canada to reinforce the integrity of its helicopter fleet and ensure the Canadian Coast Guard has the necessary infrastructure and support to hire and train the staff to operate its future marine vessel fleet;

- $29.9 million over two years to Transport Canada for the Ferry Services Contribution Program to support the continued safe and reliable operation of ferry services in Eastern Canada;

- $27.2 million over five years to Transport Canada to establish a Transportation Supply Chain Office. This office will allow industry and government to respond to disruptions and better coordinate action to increase the capacity, efficiency, and reliability of Canada’s transportation supply chain infrastructure; and

- $25 million over five years to Transport Canada to work with Statistics Canada to analyze transportation supply chain data that will help reduce congestion, make supply chains more efficient, and inform future infrastructure planning.

Funding for Public Infrastructure

- $576.1 million over five years to Jacques Cartier and Champlain Bridges Incorporated to operate, maintain, and repair its infrastructure in the Greater Montreal Area;

- $210.0 million over five years to VIA Rail to conduct route and train maintenance outside the Québec City-Windsor Corridor and to maintain levels of service across its network;

- $42.8 million over four years to construct, maintain, and upgrade stations and maintenance centres in the Québec City–Windsor Corridor;

- $33 billion in funding for public infrastructure across the country through the Investing in Canada Infrastructure Program (ICIP).

Technological and Innovation Investments

With strong business ecosystems, world-class research, and a skilled workforce across the country, Canada is becoming a leader in global technology, growing quickly in areas such as artificial intelligence (AI). To reach Canada’s potential, the Federal Budget 2023 announces new measures to encourage business innovation, including new investments for forestry, research, and the agriculture sector.

Investing in Canadian Technological Research

- $150 million over five years to the Canadian Space Agency for the next phase of the Lunar Exploration Accelerator Program which supports Canada’s world-class space industry and helps accelerate the development of innovative technologies;

- $108.6 million over three years to expand the College and Community Innovation Program, administered by the Natural Sciences and Engineering Research Council (NSERC);

- $1.1 billion over 14 years to the Canadian Space Agency to continue Canada’s participation in the International Space Station until 2030;

- $1.2 billion over 13 years to the Canadian Space Agency to develop and contribute a lunar utility vehicle to assist astronauts on the moon; and

- $76.5 million over eight years to the Canadian Space Agency in support of Canadian science on the Lunar Gateway station.

Canada’s Resource Sectors

Canada is home to some of the most resource-rich lands in the world. Paired with strong infrastructure for generating new energy sources, this creates a significant opportunity for the nation to capitalize on these economic drivers and become a world leader in sustainable and efficient energy.

Clean Energy

To maximize the benefits from Canada’s offshore wind potential, especially off the coasts of Nova Scotia and Newfoundland and Labrador, it is imperative to stimulate science-based investment activities.

- A series of interprovincial transmission lines called the Atlantic Loop will be implemented over the next few years to provide clean electricity to Quebec, New Brunswick, and Nova Scotia with a projected completion date of 2030;

- Clean electricity and clean growth infrastructure projects will receive $20 billion in investments from the Canada Infrastructure Bank, specifically directed towards clean power and green infrastructure projects;

- An estimated $3.0 billion will be paid via Natural Resources Canada (NRC) over the next 13 years for projects designed to spur greater impacts from Canada’s clean energy grid:

- The Smart Renewables and Electrification Pathways Program is designed to address critical regional priorities and support projects led by Indigenous groups; and

- The Smart Grid program will be renewed to continue to support the development of electric grid innovations.

Critical Minerals

The Critical Minerals Infrastructure Fund will receive $1.5 billion for the development of energy and transportation projects that will help unlock priority mineral deposits.

Investments for Canadian Forestry

In many rural and Indigenous communities, the forestry sector plays a significant role in Canada’s natural resource economy. In response to the growing global demand for sustainable forest products, Canada will continue to support its forestry sector to enable it to innovate, grow, and provide good middle-class jobs for Canadians.

- $368.4 million over three years to Natural Resources Canada to renew and update forest sector support, including research and development, Indigenous and international leadership, and data collection and analysis. Of this amount, $30.1 million would be sourced from existing departmental resources.

Investments for Agriculture Producers

Agriculture is among Canada’s top sectors for productivity output and key to economic success. Federal Budget 2023 delegates millions in agri-support with new funding programs for agri-producers and facilities.

The New Dairy Innovation and Investment Fund

Solidsnot-fat (SNF), a by-product of dairy processing, are a growing problem in the dairy sector. Dairy processors and farmers lose opportunities due to limited processing capacity for SNF.

- $333 million over ten years to Agriculture and Agri-Food Canada to support research and development of new products based on SNF, develop markets for these products, and increase processing capacity for SNF-based products.

Supporting Farmers and Producers

- $57.5 million over five years to the Canadian Food Inspection Agency to establish a Foot and Mouth Disease (FMD) vaccine bank for Canada, and to develop FMD response plans;

- $34.1 million over three years to Agriculture and Agri-Food Canada’s On-Farm Climate Action Fund to support adoption of nitrogen management practices by Eastern Canadian farmers that will help optimize and reduce the use of fertilizer; and

- $13 million to Agriculture and Agri-Food Canada to increase the interest-free limit for loans under the Advance Payments Program from $250,000 to $350,000 for the 2023 program year.

Investments in Indigenous Priorities

In the Federal Budget 2023, the government in continuing to build on the progress made since 2015 with billions in investments for advancing reconciliation, protecting Indigenous environments, and building stronger and more inclusive communities. With new investments in additional to ongoing key measures outlined in Budget 2022, Canada plans to help everyone share in the prosperity and opportunities which the country provides.

Indigenous Healthcare

- $810.6 million over five years to support medical travel and maintain medically necessary services through the Non-insured Health Benefits Program, including mental health services, dental and vision care, and medications.

Indigenous Governance, Capacity, and Participation

- $76.3 million to Indigenous Services Canada to continue building the administrative capacity of First Nations governments and tribal councils delivering critical programs and services to their members;

- $19.4 million over five years to Crown-Indigenous Relations and Northern Affairs Canada for the Northern Participant Funding Program to increase the participation of Indigenous Peoples and other Northerners in environmental and regulatory assessments of major projects;

- $8.7 million to Natural Resources Canada to support meaningful engagements with Indigenous partners and Indigenous rights-holders towards the development of the National Benefits-Sharing Framework;

- $5 millionto Indigenous Services Canada to support the co-development of an Economic Reconciliation Framework with Indigenous partners that will increase economic opportunities for Indigenous Peoples, communities, and businesses;

- $1.6 million over two years to the Canadian Northern Economic Development Agency for the Northern Projects Management Office; and

- The Canada Infrastructure Bank will provide loans to Indigenous communities to support purchasing equity stakes in infrastructure projects in which the Bank is also investing.

Protecting Canada’s Freshwater and Nature

Healthy lakes and rivers are essential to Canadians, communities, and businesses across the country. The federal government is moving forward to establish a new Canada Water Agency and make major investments in a strengthened Freshwater Action Plan.

- $650 million over ten years to support monitoring, assessment, and restoration work in the Great Lakes, Lake Winnipeg, Lake of the Woods, St. Lawrence River, Fraser River, Saint John River, Mackenzie River, and Lake Simcoe;

- $184 million over three years to Environment and Climate Change Canada, Parks Canada, Fisheries and Oceans Canada, and Natural Resources Canada to continue the preservation and recovery of species at risk; and

- $85.1 million over five years to support the creation of the Canada Water Agency, which will be headquartered in Winnipeg.

Investments in Natural Disaster Prevention and Resilience

Climate change is making extreme weather more frequent. It is common for homes and communities to suffer severe damage because of extreme weather events. In such unforeseeable events, it is imperative that people have access to affordable property insurance so that natural disasters do not lead to unnecessary financial hardships.

The Federal Budget 2023 announced the federal government’s intention to launch, in partnership with provinces and territories, a new approach to address gaps in natural disaster protection and help Canadians access affordable insurance.

- $48.1 million over five years and $3.1 million ongoing, to Public Safety Canada to identify high-risk flood areas and implement a modernized Disaster Financial Assistance Arrangements program, which would incentivize mitigation efforts;

- $31.7 million over three years to Public Safety Canada and the Canada Mortgage and Housing Corporation to work with the Department of Finance Canada to offer a low-cost flood insurance program, aimed at protecting households at elevated risk of flooding and without access to adequate insurance; and

- $15.3 million over three year to Public Safety Canada to create a publicly accessible online portal where Canadians can access information on their exposure to flooding.

Investments for Canadian Tourism Sector

Canada’s tourism sector was deeply impacted by the COVID-19 pandemic. The Government of Canada provided $23 billion in emergency support to help the industry recover during the pandemic. With travel resuming, the industry is beginning to rebound, creating an opportunity to invest in Canada’s tourism sector and ensure it continues to be a driver of good jobs and vibrant communities across the country.

- $108 million over 3 years to the Regional Development Agencies to support communities, small businesses, and non-profit organizations developing local projects and events;

- $50 million over 3 years to Destination Canada to attract major international conventions, conferences, and events to Canada; and

- $40 million over two years to the Department of Canadian Heritage to open funding from the Canada Media Fund to traditionally underrepresented voices and to increase funding for French-language screen content.

Supporting Communities with Arts and Heritage Funding

Administered via the Building Communities Through Arts and Heritage program, the Government of Canada provides support for artists, artisans, and heritage performers through festivals, events, and projects.

- $14.0 million over two years, starting in 2024-25, for the Department of Canadian Heritage to support the Building Communities Through Arts and Heritage program.

Tax Updates

Canada’s Federal Budget 2023 provides many new government tax incentives, as well as updates to existing programs designed to help businesses in key sectors reduce costs and enticing organizations to invest heavily in research and development, business expansion, and other business activities that benefit the Canadian economy.

To read a comprehensive review of all the top tax updates from federal budget 2023, please read the Ryan Tax Alert.

The Clean Electricity Investment Tax Credit

Those investing in non-emitting electricity generation systems, abating natural gas-fired electricity generation, stationary electricity storage systems that do not use fossil fuels in operation, and transmission equipment between provinces and territories will qualify for the Clean Electricity Investment Tax Credit, a 15% refundable tax credit.

The Clean Technology Manufacturing Investment Tax Credit

The Clean Technology Manufacturing Investment Tax Credit is expected to be a refundable tax credit equal to 30% of the cost of investing in new machinery and equipment for manufacturing or processing key clean technologies, as well as extracting, processing, or recycling key critical minerals. This tax credit is projected to cost $4.5 billion over a five-year period. During 2023-24, the tax credit will be available for property purchased and made available for use on or after January 1, 2024, with a further increase of $6.6 billion during the period of 2028-29 to 2034-35.

Small Business Grants and More Funding Opportunities for Canadian Companies

The programs mentioned in Federal Budget 2023 are only a small portion of government funding and tax incentive programs available for Canadian businesses. To see a full list of active programs across different sectors, in various provinces, and for different activities, visit our government funding directory page.

The Mentor Works, a Ryan company, team is committed to providing information and support on the latest in Canadian government funding. Sign up for our free weekly funding newsletter to receive updates, success stories, business strategy blogs, and more about current and upcoming programs as they are released throughout the calendar year.