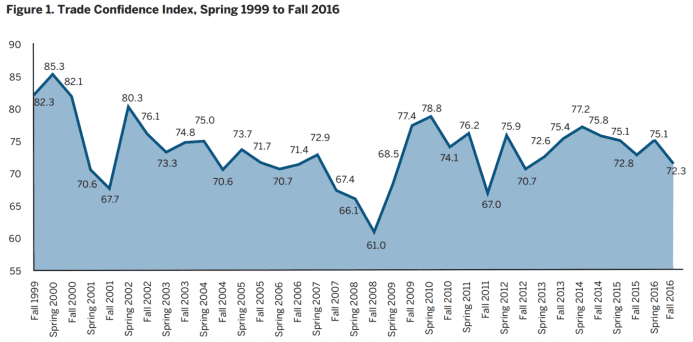

Canadian Exporters Confidence in 2016 Drops to Lowest Point Since 2012

Approaching the end of an uninspiring 2016, Canadian export confidence slipped to its lowest recorded point since Fall 2012. This decline make sense; in a year marked by Mexico’s overtaking as the United States’ #2 exporter and the election of Donald Trump, Canadian businesses are waiting cautiously to see what the future brings.

The Trade Confidence Index (TCI) is a bi-annual report produced by Export Development Canada (EDC) based on surveys conducted with Canadian exporters. The insights within this article are based on EDC’s latest survey of 719 exporters who answered questions regarding five elements of export success.

In Fall 2016, Canadian exporters recorded a TCI of 72.3, dropping 2.8 points since Spring 2016. This decline is also defined by slipping trade confidence among companies of all sizes, sectors, and regions. Most shocking was that all five TCI exporting condition measurements lost ground compared to EDC’s previous report.

Confidence in Canadian Exports Declines to 4-Year Low

Canada’s Trade Confidence Index fell to 72.3 in Fall 2016 from 75.1 in Spring 2016. Although export confidence only marginally fell since one year ago, it was enough to drop behind Fall 2012 levels, where Canadian exporters recorded a score of 72.6.

Picture Source: Export Development Canada (EDC) in EDC Trade Confidence Index Survey, Fall 2016

What caused overall trade confidence to decrease? There are numerous factors identified through the study, including:

- Political changes influencing domestic/international investments;

- A 6% decline in businesses that have begun exporting to new markets over the past 2 years;

- A 5% decline in businesses that plan on exporting to new markets over the next 2 years; and

- 11% fewer respondents expecting domestic economic conditions to improve over the next 6 months.

Still, EDC’s Trade Confidence Index survey respondents remained mostly neutral or optimistic about export conditions over the next 6 months. Since the last survey, fewer exporters are expecting conditions to improve, but the majority still expect relatively unchanged market conditions.

Some of the positives that were identified include:

- The Canadian dollar continues to sustain exporting competitiveness. If the average exchange rate was sustained over the next two years and all other variables were fixed, 98% of exporters would expect sales growth.

- 54% of survey respondents indicated that they expect increased export sales over the next six months, compared to 6% projecting fewer export sales.

Free Download: The Canadian Business Guide to Export Expansion

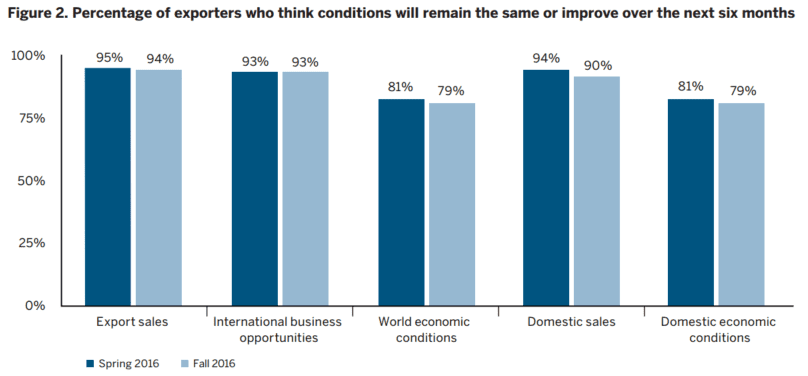

6-Month Export Outlook by Trade Confidence Index Criteria

There are five criteria EDC uses to determine trade confidence, including export sales, international business opportunities, world economic conditions, domestic sales, and domestic economic conditions. While each category lost ground 6 months ago, exporters still seem to be quite optimistic, as highlighted through the chart below.

Picture Source: Export Development Canada (EDC) in EDC Trade Confidence Index Survey, Fall 2016

Export sales remained the strongest of TCI measurements with 54% of survey respondents indicating increased export sales projections over the next 6 months. Of these growth leaders, nearly a quarter believed innovation and productivity enhancements to be the top reason. 6% of respondents expect lower sales; one-third attribute this to lower demand for their products.

International business opportunities are expected to improve for nearly 30% of exporters, primarily because of the Canadian dollar’s lower value. 7% of exporters expect fewer international opportunities to arise in the next 6 months, with some fearing oil/gas production rates and world instability.

World economic conditions only declined slightly during mid-2016, and 79% of Canadian exporters believe conditions will improve or stay the same over the next 6 months. Nearly half of the respondents who answered negatively attributed their concerns to world recessions and global instability and 16% cited wars in Iraq, Syria, and other Middle Eastern nations.

Domestic sales are expected to increase for up to 40% of Canadian exporters over the next 6 months, a decline from 45% in Spring 2016. The main factor leading to increased domestic sales is the acquisition of new customers or contracts, which 16% of businesses report will be an essential short-term strategy.

Domestic economic conditions fell harshly between Spring 2016 and Fall 2016, with 11% fewer businesses believing conditions will improve over the next 6 months. Over 1/5 of survey respondents held a negative outlook of domestic economic conditions; 41% of those people cited political changes and government initiatives to be the central cause of their pessimism.

Small Business Export Grants Can Fuel International Trade

A portion of Canadian exporters may not be aware of the Canadian government grants and incentives aimed at supporting international expansion. Because of this, exporters could be missing the opportunity to optimize export expansion projects’ return-on-investments (ROI).

This doesn’t have to be the case. Canadian exporters currently have access to a variety of export funding and trade programs designed to support market expansion. These include:

CanExport: Export Market Development Grants

CanExport funding supports the development of international markets (countries) where less than 10% or $20,000 of total international sales have been earned in the last 24 months. This includes travel to the market, participating at one trade show, and translating marketing materials (if necessary) to attract clients in the foreign market.

Project expenses can be reduced by up to 50% through the CanExport funding program. This enables Canadian exporters to recover between $10,000 to $50,000 in small business grants.

Going Global Innovation: International Technology Development Grants

Canadian exporters forming international technology development collaborations may seek funding through Going Global Innovation (GGI). This trade program is designed to reduce communication barriers with potential international partners by encouraging travel and meetings to solidify the collaboration.

Canadian-based small and mid-sized enterprises (SMEs) may be eligible to receive up to 75% of project expenses to a maximum export grant of $75,000.

Canadian International Innovation Program (CIIP): Technology Commercialization

Businesses within Canada should seek partnership with international companies to accelerate research and development projects. The Canadian International Innovation Program (CIIP) seeks to offset a portion of the costs related to performing R&D projects in partnership with a foreign entity.

Canadian SMEs may be eligible for up to 50% of project expenses to a maximum $600,000 in research and development grants. Only partners located in specified countries may be used for this export funding.