Current Trend Reinforces Need to Reward Small Businesses for Export-Led Growth

New data has been released by Statistics Canada on August 24th, 2014 through the Survey of Innovation and Business Strategy, 2012. The survey results describe how Canadian firms measure their performance, whether their success depends on domestic or international markets, and who is rewarded for the company’s achievement.

Only 60.2% of Small Businesses Rely on Gross Margin & Operating Margin Growth as Most Important Performance Metrics

The survey found that 76.7% Canadian small businesses rely on sales and income growth as the most common performance indicators. The prominence of these metrics were followed by gross margin and operating margin growth, which 60.2% of small businesses cited as the metrics that best help identify performance.

Furthermore, 79.8% of Medium-sized businesses, and 76.2% of small enterprises used sales and income growth as their principal indicator to measure their long-term strategic growth objectives. Meanwhile, large enterprises were more likely to apply the principal performance measures of gross margin and operating margin growth (78.0%) while 77.4% also relied on sales and income growth.

More than 60% of Small Businesses Focus on Local Markets

Within the same Statistics Canada report, smaller Canadian enterprises were found to be nearly twice as dependent upon sales from local markets. 60.7% of small enterprises surveyed claim to rely on local markets in terms of percentage of sales of their highest selling product; whereas, 51.4% of medium-sized enterprises and 31.8% of large enterprises admitted to relying upon local markets. What is more concerning is that of Canadian manufacturers, three-quarters of the total sales of their highest selling good or service came from within Canada, although only half of Canada’s large manufacturers relied on local markets during the time of the survey. When it came to service providers the number of overall firms that relied on local markets shot up to 90%.

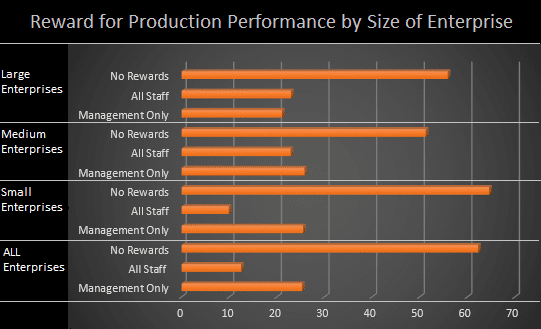

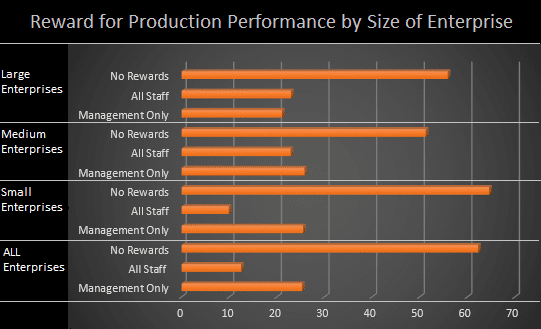

Only 10% of Employees from Small Businesses will See Financial Rewards for their Company’s Success

The survey also shed light on how company’s of various sizes reward employees for their firm’s performance. Contrary to popular belief, working at a small business is not more likely to entitle you to financial rewards for the firm’s success. While it is true that employees may look forward to seeing their positions and/or responsibilities grow along with the company, a dismal 9.9% of employees received financial rewards tied to the success of their company, compared with 23% of medium and large firms.

Source: Statistics Canada

Small Business Forecast: What to Look Forward to in 2014?

While it is still difficult to tell whether 2013 and 2014 figures will break from the 2009/2012 trend, innovative small and medium-sized businesses can take advantage of generous small business grants and loans to further their export-led growth. Learn more about a variety of grant and loan options for established small and medium-sized businesses that are planning to, or are currently involved in trade to international markets. Sign up for a Free Canadian Government Funding Workshop to learn more.