BDC Capital and IAF Capital: Venture Capital for Technology Companies

Canada’s technology sector is a cornerstone of the booming knowledge economy. It’s supported by some of the world’s top post-secondary institutions and is also favourably impacted by immigration policies, which see some of the world’s top technology entrepreneurs come to Canada to launch new ideas. At a time where technology’s importance is surging globally, Canada is well-positioned to become a world leader for starting and nurturing technology companies.

But despite improvements to improve access to capital for early-stage technology businesses, it can still be incredibly difficult to receive large-scale investments needed to realize technological breakthroughs. Often, Canadian businesses struggle to reach the growth rates necessary to become world-leaders, and get acquired by larger technology companies.

Although acquisitions may be an achievement for many technology entrepreneurs, it can stifle economic growth here in Canada where jobs and investment are better kept. Still, many Canadian technology companies are being consumed by larger, fast-moving American businesses. For Canada to develop a robust technology sector, it must effectively invest in these companies. This includes investing early, and investing adequate amounts of capital.

The federal and provincial governments across Canada understand this need for technology capital, which is part of the mandate of two government-backed venture capital (VC) funds. The Business Development Bank of Canada (BDC) and Investment Accelerator Fund (IAF) both provide seed and growth funding to help tech sector companies finance growth and attract future investment.

BDC Capital and IAF Capital: Financing for Early-Stage Tech Companies

Canada’s tech sector has long been admired as a place where innovative businesses get their start, yet few grow to a size where they become a globally recognized company. This is not necessarily at the fault of these business; usually it makes good sense to exit when international organizations make a qualified acquisition offer. Yet every time this happens, the Canadian economy suffers.

To avoid being acquired by faster-growing technology companies, Canada must create an environment where technology startups can grow and compete at a high level. This environment requires additional expertise and financial resources need to support the types of economy-growing companies that are so prevalent in California’s Silicon Valley.

Luckily, there are two government-backed venture capital funds in Canada that can support the scaling-up of early-stage technology companies. Both funds eagerly support tech companies, but understanding the subtle similarities and differences of each can help entrepreneurs decide how to get the best support possible.

Consider how each venture capital fund may improve your business’ current and long-term growth priorities.

BDC Capital: Canada-Wide Tech Sector Support

The Business Development Bank of Canada’s venture capital arm was created in the 1980’s, at a time where VC funding was not as available as it is now. There were fewer local funders available to provide the amount and types of financing needed for businesses, especially technology companies. This resulted in a business climate that stifled innovation and prevented the rapid growth of early-stage companies.

Now with over 30 years of experience and over $1 billion of capital under management, BDC is one of Canada’s largest VC funds. Their support has helped over 400 Canadian companies scale effectively; and unlike other VCs, there is no cap on the amount of funds that it can invest in a company, and it can invest at any stage of business development.

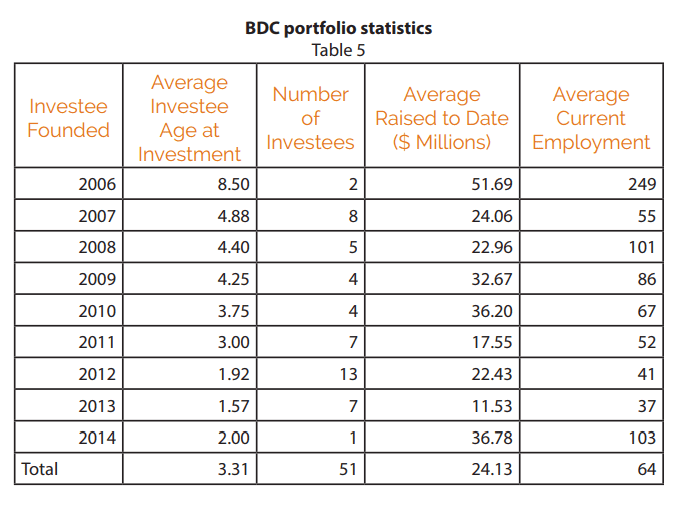

The Impact Centre’s analysis of BDC’s portfolio indicates that BDC invests in businesses around the 3.3 year mark, recipients raise (with BDC and other investors) an average of $24.13 million in financing, and maintain an average employee count of 64.

Although BDC can invest in companies early in their development, they have historically waited to provide investment later in a business’ growth cycle, since this is less risky and shows that there is interest from other investors/customers before they get involved. Because of this waiting, BDC capital contributes a large portion of funds towards businesses and supports their development into word-leading companies.

Despite BDC historically investing in later-stage technology companies, recent years have shown a transition to funding earlier-stage companies. Between 2012 and 2014, the average age of an investee did not surpass two years; this is a stark contrast to their strictly mature business portfolio of the early-mid 2000’s.

This is important since nurturing businesses is only valuable when there’s an abundance of mid-growth companies to invest in. Increasingly, companies are being acquired before the they are looking for Series B or C investments. To help these companies develop independently, BDC must continue investing earlier and providing help to companies with seed funding or Series A investment.

IAF Capital: Ontario Tech Sector Funding

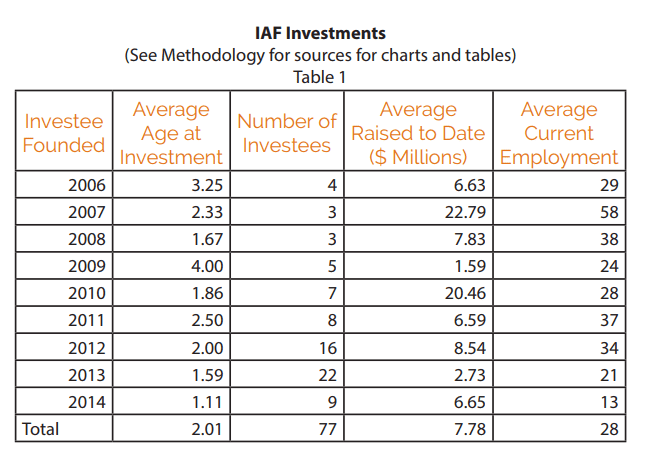

Alternately, the Investment Accelerator Fund (IAF) was established in 2007 by the Province of Ontario. Its original mandate was to mitigate technological and market risk in tech sector startups, providing seed funding to a maximum $500,000. Compared to other forms of financing available, IAF capital was an attractive option for companies with limited revenue and institutional investments.

In 2010, the Investment Accelerator Fund portfolio was shifted from management under the Ontario Centres of Excellence (OCE) to the MaRS Discovery District, an organization more aligned to the development of early-stage tech companies. Since this shift, IAF has been able to intervene earlier in the development of businesses and provide seed funding when it’s most helpful.

As of August 2017, IAF has invested in 126 companies with 71% going on to receive follow-up funding from other sources. The Impact Centre’s analysis of IAF’s portfolio indicates that the fund invests in businesses around the 2 year mark, recipients raise (with IAF and other investors) an average of $7.78 million in financing, and maintain an average employee count of 28.

Because IAF becomes involved earlier in a business’ growth cycle, their investments tend to be smaller (approximately $1.6 million/investee). Despite the importance and timeliness of these investments early in company history, the amounts provided through IAF capital are often seen as insignificant and do not provide the amount needed to grow the company sufficiently. With limited funds, these companies grow slower and are not as attractive to investors providing Series A, B, or C financing.

As result, many of the companies funded through IAF have more limited growth trajectories and do not stimulate further investments as well as BDC-backed organizations. With fewer resources, these companies are at a much greater risk of being acquired by larger firms before they can reach their full market potential. For IAF to improve outcomes for the businesses it invests in, larger amounts of funding must be provided.

Opportunities to Improve Tech Sector Growth Rates

While both BDC capital and IAF capital provide early-stage technology companies with support, both would provide greater benefit to businesses and the Canadian economy if they provide more financial support earlier in company development. This additional capital will help companies hire the talent and develop the technologies needed to compete globally. Furthermore, it will also help prevent the acquisition of firms before international companies seek acquisition.

Technology companies should evaluate both options as ways to grow their business, as receiving significant investment early in company development is one of the best strategies to ensure sustained growth and competitiveness. Within the first years of starting a business, these are two of the best options available to entrepreneurs.

Post-Startup Funding: Canadian Government Grants and Loans

To keep the momentum of these capital investments, early-stage businesses can also explore Canadian government funding programs. Although these usually exclude startups and early-stage businesses (and therefore cannot be used to replace seed funding), they can support incorporated, early stage businesses that are looking to improve growth rates and avoid acquisition.

To explore government grants and loans for small businesses, please contact Mentor Works or register for our weekly small business funding newsletter.