Canada Recovery Hiring Program – COVID-19 Wage Subsidy after CEWS Ends

The Canada Recovery Hiring Program is a COVID-19 funding support program announced in the Federal 2021 Budget that provides up to 50% of employee wages to a maximum of $1,129 per week for businesses that have been hit the hardest by the pandemic. The hiring program will offset a portion of the extra costs employers must take on as they reopen. These costs could include increased wages, hours worked, or hiring more staff.

The COVID-19 funding program is estimated to cost $595 million in 2021 – 2022.

This program comes into effect as the Canada Emergency Wage Subsidy ends its support in June of 2021. The Canada Recovery Hiring Program is only available for active employees and will be available from June 6 to November 20, 2021. The federal government is looking to have this program expand to include hiring new workers as the economy reopens.

Eligible Employers

The federal government has stated the following eligibility criteria for the Canada Recovery Hiring Program:

- Businesses and organizations eligible include:

- Canadian-controlled private corporations;

- Individuals;

- Non‑profit organizations;

- Registered charities; and

- Certain partnerships.

- Must have a payroll account with the Canada Revenue Agency (CRA) that was active on or before March 15, 2020.

- Must meet the revenue-decline threshold for a qualifying period.

Eligible Employees

Eligible employees must be:

- Primarily employed in Canada;

- Actively employed by an eligible employer during the eligible periods listed below; and

- Non-arms-length (i.e. Not a business owner and not a direct family member).

Employees who are on leave with pay but do not perform any work for the employer are ineligible for the Canada Recovery Hiring Program. Common examples of this include vacation leave, sick leave, or a sabbatical.

Eligible Expenses

The amount of remuneration for employees is based solely on remuneration paid during the qualifying period (listed below). There is a maximum of $1,129 per week for each employee which can include:

- Salary;

- Wages; and

- Other remuneration for which employers are required to withhold or deduct amounts on account of the employee’s income tax obligations.

Items such as severance pay, stock option benefits, or the personal use of a corporate vehicle are not eligible for funding.

Eligible Periods

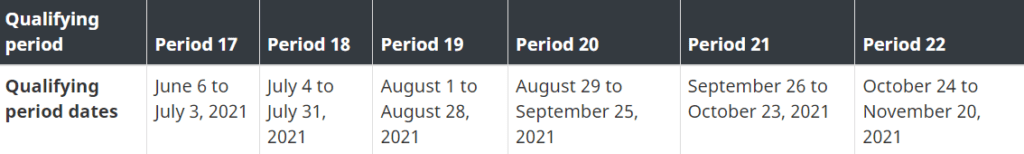

Similar to the eligible periods of CEWS, the Canada Recovery Hiring Program operates with periods for which businesses will need to reapply for funding. These periods start directly after CEWS’ last eligible period ended (Period 16: May 9 – June 5, 2021).

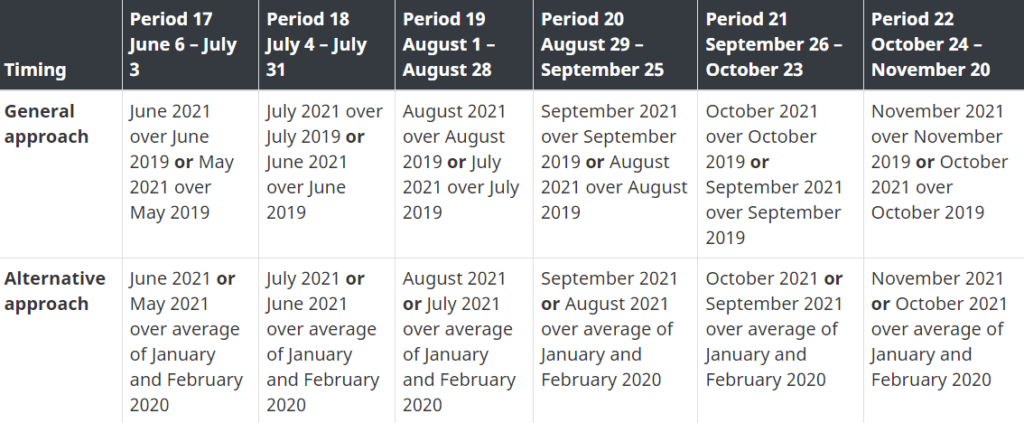

Revenue-Decline Threshold

Eligible businesses must show a large enough drop in their revenue due to the pandemic in comparison to their 2019 pre-COVID-19 revenue. Each period has a different comparison date as listed below:

All employers must have a minimum decline in revenue of:

- More than 0 per cent for the qualifying period between June 6, 2021 and July 3, 2021.

- More than 10 per cent for qualifying periods between July 4, 2021 and November 20, 2021.

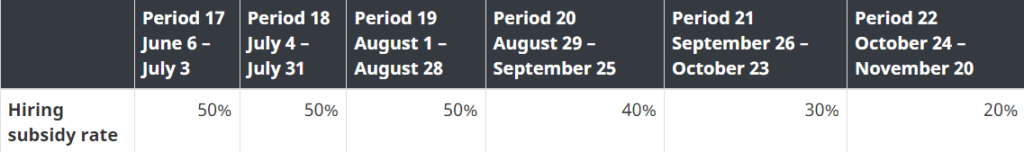

Subsidy Amount

If a Canadian business meets all of the above requirements for the Canada Recovery Hiring Program, they can receive the following portion of their employees’ salary, wages, or other remuneration.

Apply for the Canada Recovery Hiring Program

At the time of writing, the application portal for the Canada Recovery Hiring Program is not open, but will be available to all Canadian businesses through the Canada Revenue Agency business portal when the intake period begins. This program can provide retroactive funding to June 6, 2021. For all other federal and provincial government grant, loan, and wage subsidy programs, be sure to visit our Canadian government funding programs page to find a program that aligns with your upcoming business growth and recovery projects.

As provinces begin reopening from the third wave of the pandemic, the Canadian federal and provincial governments are introducing new business support programs. Be sure to visit our COVID-19 support page for the latest info on government grants, loans, and wage subsidies.

Please provide me with more information on how to apply for the CRHP, more specifically for those who did NOT have a payroll account yet in March 2020, but were already in business for 18-24 months prior.

Thank you for your time,

Hi Richard – As of the date of this comment, the Canada Recovery Hiring Program specifies that the program is accessible to businesses that “had a CRA payroll account on March 15, 2020 (exceptions apply in payroll provider and asset acquisition situations)”. For more information and the complete list eligibility factors, please visit the official Canada Recovery Hiring Program webpage.